Disclosures to Clients - What and When

The "Focus on Ethics" article series takes a close look at topics important to understanding CFP Board's Code of Ethics and Standards of Conduct.

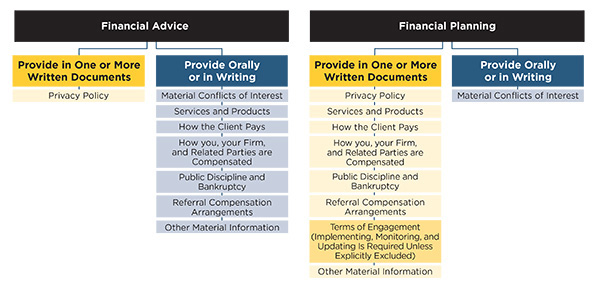

Under CFP Board’s new Code of Ethics and Standards of Conduct (“Code and Standards”), which takes effect on October 1, 2019, a CFP® professional has a duty to provide information to a Client. Whether information may be provided orally or must be provided in writing depends upon whether the Financial Advice that is being provided requires Financial Planning.

Section A.10.a outlines the information that CFP® professionals must provide to Clients in Financial Advice engagements:

When providing or agreeing to provide Financial Advice that does not require Financial Planning in accordance with the Practice Standards, a CFP®professional must provide the following information to the Client, prior to or at the time of the Engagement, and document that the information has been provided to the Client:

- A description of the services and products to be provided;

- How the Client pays for the products and services, and a description of the additional types of costs that the Client may incur, including product management fees, surrender charges, and sales loads;

- How the CFP® professional, the CFP® Professional’s Firm, and any Related Party are compensated for providing the products and services;

- The existence of any public discipline or bankruptcy, and the location(s), if any, of the webpages of all relevant public websites of any governmental authority, self-regulatory organization, or professional organization that sets forth the CFP® professional’s public disciplinary history or any personal bankruptcy or business bankruptcy where the CFP® professional was a Control Person;

- The information required under Section A.5.a. (Conflict of Interest Disclosure);

- The information required under Section A.9.d. (Written Notice Regarding Non-Public Personal Information);

- The information required under Section A.13.a.ii. (Disclosure of Economic Benefit for Referral or Engagement of Additional Persons); and

- Any other information about the CFP® professional or the CFP® Professional’s Firm that is Material to a Client’s decision to engage or continue to engage the CFP® professional or the CFP® Professional’s Firm.

Section A.10.b outlines the information that CFP® professionals must provide to Clients in Financial Planning engagements. That information includes the required disclosures described in Section A.10.a.i.-iv. and vi.-viii., as well the terms of the Engagement between the Client and the CFP® professional or the CFP® Professional’s Firm, including the Scope of Engagement and any limitations, the period(s) during which the services will be provided, and the Client’s responsibilities. A CFP® professional is responsible for implementing, monitoring, and updating the Financial Planning recommendation(s) unless specifically excluded from the Scope of Engagement.

Below is a diagram summarizing the categories of information that must be shared with the Client, and whether the information must be provided orally or in writing.

CFP Board has prepared a Financial Advice Engagements Disclosure Guide and a Financial Planning Engagements Disclosure Guide, both included in the “Roadmap to the New Code and Standards”. These Disclosure Guides provide an easy to reference description of a CFP® professional’s Duty to Provide Information to a Client, including identification of documents that may contain the information required to be provided, and details on when the information must be provided to the Client, as well as when to update the information.

The requirement to provide information to a Client set forth in CFP Board’s Code and Standards is in addition to any requirements that apply under applicable law.

Access More Guidance Materials

This compliance resource is part of a full library of resources that CFP® professionals can use to comply with the Code and Standards. More guidance materials can be found in our Compliance Resources Library.