Amid Fears of Recession, Americans Find Confidence through Financial Advice and Planning

As we continue to enjoy the fruits of this record-breaking bull run, macroeconomic pundits and news outlets are stoking the flames of recession fear, citing a litany of macroeconomic indicators, including the once arcane “inverted yield curve.” Somewhat predictably, concern and awareness about a near-term recession has spread to the American public. In a survey conducted in October 2019, CFP Board found that 55 percent of adults believe a recession will occur in the next year.

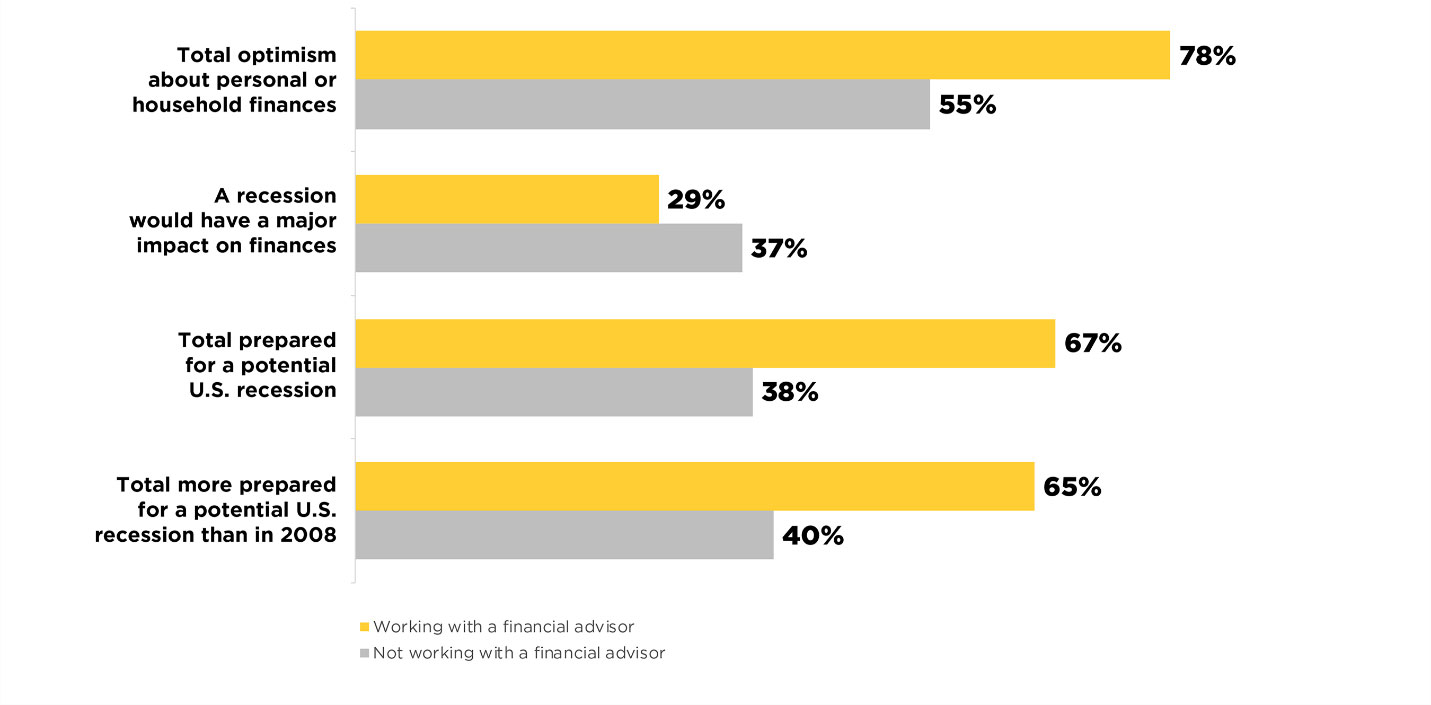

Despite this gloomy prognosis, the study also found that those who work with a financial advisor and have a written financial plan in place feel much more confident that they can weather any economic storm.

Financial advisors have made a difference in helping people feel prepared

According to the survey, nearly two-thirds of adults working with a financial advisor said they feel more prepared now for a potential recession than they did in 2008. When we looked specifically at those who work with a CFP® professional, 73 percent of respondents said they feel more prepared now than they did in 2008.

Additionally, the survey found that adults working with a financial advisor (67 percent) are much more likely to say they would feel prepared for a recession than those who are not working with a financial advisor (38 percent). What’s more, 59 percent of people working with an advisor say that a recession is likely to have minor to no impact on their household, and three-quarters (77 percent) said they are confident their advisor would successfully manage their finances through a recession.

When looking at these findings, it is clear many Americans are concerned about the possibility of a recession occurring within the next twelve months,” said Kevin R. Keller, CEO of CFP Board, in a press release speaking to the findings of the survey.

The aftermath of the 2008 financial crisis and subsequent recession was traumatic for consumers across the country, which has obviously elevated the overall concern among consumers about the next downturn.

But these results should be encouraging.

“Those who work with a financial advisor – and specifically a CFP® professional – have much more confidence about their finances when faced with the prospect of a recession,” said Keller. “While we will not know precisely when the next recession will occur, it is imperative that consumers feel prepared and assured in their ability to withstand the pressures of a financial downturn.”

The role of the financial planner

Recessions can wreak havoc on the average person’s finances. Whether it be financial health, job security or investment losses, economic downturns have the potential to create life-altering financial problems.

With their expertise and experience, financial planners play a vital role helping consumer navigate these challenges.

By helping their clients plan ahead and develop strategies to manage cash flow, pay down high-interest debt and build up an emergency fund, financial planners alleviate the anxiety commonly associated with recessions and ensure they are prepared for the very worst circumstances.

In fact, CFP Board’s Let’s Make a Plan blog has published a series of consumer-focused articles related to recessions including a post called Seven Ways to Prepare for a Recession and the Next Bear Market.

As any downturn comes closer, the financial planning profession has never been more vital to the confidence of American consumers. The results of this survey demonstrate a clear need for financial advice among the general public. Take advantage of your role as a CFP® professional to help narrow that gap – offer your clients and prospects an opportunity to create or refresh their plan before a downturn hits.